Tuesday, March 1, 2016

Alternatives to a limited AFS licence: what issues should I consider?

Thursday, February 11, 2016

Accountants need to get RG 146-compliant now

- Securities

- Managed investments

- Deposit products

- Life insurance

- General insurance

Friday, February 5, 2016

New - Limited AFS Licence Application

- "Core proofs" - these

are the essential documents that all applicants must prepare as part of

their application

- "Non-core proofs" (additional

proofs) - this is additional documentation of compliance policies and

procedures that you must provide if requested by ASIC

- Question-by-question guidance

on completing the online ASIC application form

- An Establishment Kit explaining

all the steps in the application process, and ASIC guidance on how to

prepare the required cash flow projection.

+Cleardocs Thomson Reuters

Tuesday, May 5, 2015

ASIC rejections due to an existing business name

If

the business name is held by a:

|

ASIC

registration requirements for the company are:

|

Each

trustees of the trust must be a shareholder, and a copy of the trust deed

emailed to ASIC

|

|

The

company must be a shareholder in the new company

|

Friday, January 21, 2011

Is the Certificate of Registration for a company you order online through Cleardocs sufficient to give a bank?

The Certificate of Registration for a company that ASIC sends to Cleardocs electronically — and that Cleardocs provides to its customers electronically — is the original Certificate. The only way ASIC provides its standard Certificates is electronically.

The standard Certificate is enough to open a bank account and is what most companies use.

(Apart from the standard certificate, you can order a hardcopy printed “commemorative certificate” direct from ASIC. These commemorative certificates cost extra, $39.95 each or $34.95 each for 2 or more. There are 12 different designs, for example: Australian birds, Australian icons, Agriculture, Classic, Commerce, and Technology. But ASIC makes a commemorative certificate for you only if you specifically order one direct from ASIC after your company is registered. ASIC will then send the commemorative certificate to the company. It doesn’t send them to Cleardocs.)

Bank rejection? Occasionally when someone is trying to set up a bank account for a company, the bank rejects the Certificate. A bank that does this — or at least, the relevant branch that does this — is several years out of date with ASIC’s systems etc.

If a bank rejects your certificate and asks “for the original certificate”, then the thing to do is to get the person at the bank to check the above information with ASIC. They can do that by:

- calling ASIC on 1300 300 630;

- when listening to the options, they should press 1, then 1 again; and

- when they speak to the person at ASIC, they should explain that they registered the company through Cleardocs and the Certificate they have given the bank came electronically from Cleardocs.

You might like to call ASIC on the number etc. above to confirm all this for yourself.

You can order a company online through Cleardocs for $549.50

You can read an Overview of some things to consider when registering an Australian company

Wednesday, December 15, 2010

SMSF Borrowing: variable interest rates and interest only loans

By Christopher Balmford, MD

Several people have asked whether the Cleardocs documents for SMSF Limited Recourse Borrowing are suitable for either of:

- a loan with a variable interest rate; or

- an interest only loan.

The answers depend on whether the lender is a bank or a related party of the SMSF.

. . . and the answers — which our lawyers at Maddocks have given us — are . . .

If the lender is a bank, then the Cleardocs SMSF borrowing documents are suitable:

- for a loan with a fixed interest rate or a variable interest rate; and

- for an interest only loan.

The arrangements about the interest rate and about what is being repaid are in the loan documents — which the bank (not Cleardocs) provides.

SMSF Borrowing from a related party

Fixed/variable interest rate If the lender is a related party, then the Cleardocs SMSF borrowing documents are suitable for:

- a loan with a fixed interest rate. Although they are not suitable for a loan with a variable interest rate, we can arrange for you to contact our lawyers at Maddocks for a free quote for the firm to manually change your documents to allow for a variable interest rate.

- a loan in which both the interest and the capital will be repaid. Although they are not suitable for an interest only loan, we can arrange for you to contact our lawyers at Maddocks for a free quote for the firm to manually change your documents to allow for a variable interest rate. (Also we are discussing with Maddocks whether to modify our documents so that you can order directly from us a document package that is interest only. We’ll keep you posted.)

What to do? If you need a document package for a loan from a related party that is interest only or that has a variable interest rate, then call us on 1300 307 343. We will arrange for you to contact Maddocks for a free quote for the firm to manually change the Cleardocs documents to meet your needs.

If (after Maddocks has given you the quote) you decide to proceed, then here’s what to do:

- First you order the normal Cleardocs $599 SMSF Borrowing (related party) document package.

- After you order the documents from Cleardocs, you email them to Maddocks and instruct Maddocks to manually change the documents to allow for a variable interest rate or an interest only loan. You can discuss this with Maddocks when you order.

- Maddocks will manually change the documents you ordered through Cleardocs to suit your needs. Maddocks will then send those documents to you ready for signing.

More information

Tuesday, December 7, 2010

Reducing the risk of ASIC Rejecting your company registration order

- by the sole director in their capacity as director and in their capacity as secretary ; or

- by the sole director and by another person who is the company secretary — to enable the company to do that, you can appoint another person as the company secretary in the question "Will any non-directors be a secretary?"

- should reduce the possibility of your application being rejected (if it is you can correct your answers and lodge again); and

- therefore should reduce the time you need to spend on getting a company registered with ASIC.

Tuesday, November 23, 2010

IS “IT” GOING WELL IN CLEARDOCS?

Thomas Lam, IT Manager

We have been using our “new” issues tracking system (JIRA) to track customers’ issues and IT projects for many months. So far, this new issues tracking system is working really well for both our IT staff and non-IT staff.

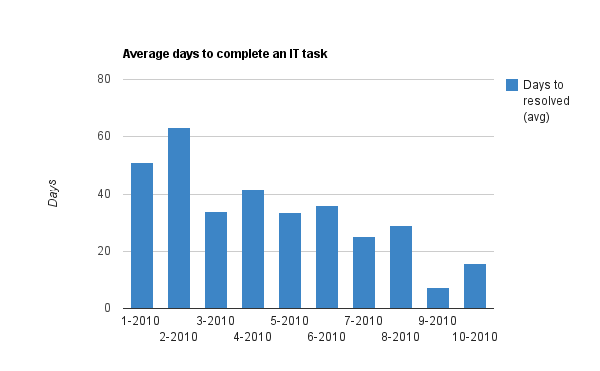

Apart from helping us to manage our IT issues efficiently, our issue tracking system also collects crucial statistics about IT issues resolutions. For instance, I could check how quickly we complete IT tasks and issues as shown in the following chart:

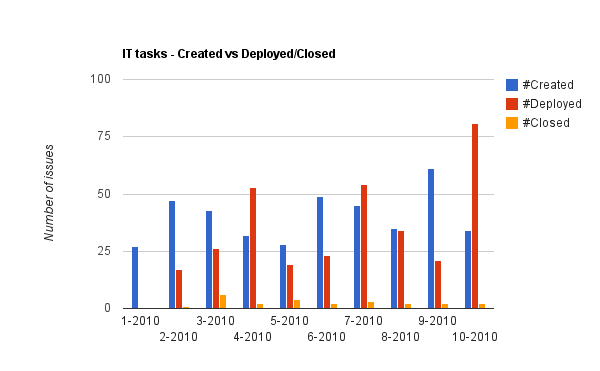

I could also check how well our department in coping with ever-increasing workload from our customers and marketing department, as depicted in the following chart:

I think we are doing well so far and we (IT) could improve on this. In three months time I’ll post more updates on these two charts. So stay tune!

Friday, November 12, 2010

Benefits of a Family (Discretionary) Trust

- a further decrease in SMSF concessional contribution limits from $50,000 to $25,000 in July 2012 for people over 50 who have accumulated more than $500,000 in super;

- the impending increase to the preservation age which prevents people from retrieving any super from their SMSF until they turn a certain age. This age will be bumped up from 55 to 60 by 2016.

Thursday, October 28, 2010

The plain-language world has changed: new plain-language law in the US, the professionalisation of the field, 2 recent conferences

Christopher Balmford, MD

A changing world

The plain-language world is changing. Here are 2 highlights:

First, on 13 October 2010, the president of the United States of America, Barack Obama, signed a law that requires federal agencies to use plain language in most government documents. The new law is largely thanks to the efforts of the Center for Plain Language — in particular, its Chair, Annetta Cheek . You can read about the new law on the Center’s site. The Act requires US government agencies to create and fill senior positions with the task of ensuring, and reporting on, compliance with the new law.

Second, the 3 major plain-language organisations have combined to form an International Plain Language Working Group which is producing an Options Paper Professionalising plain language. The paper discusses systems for setting standards for plain-language documents and systems for accrediting plain-language practitioners. It also considers a range of related topics — namely: a definition of “plain language”, more research on what makes communications clear, more advocacy for plain language, and an international plain-language institution. (By the way, the major plain-language organisations are Clarity, which has a focus on clear legal communication, internationally, PLAIN, which is about plain language in all fields and internationally, and the Center, which is about plain language in all fields but has a focus on the US.)

The new US law is likely to lead to increase in plain language everywhere. The activities of the Working Group further confirm that the plain-language world:

- should no longer be seen as “the plain-language movement”;

- but rather should be seen as “the plain-language profession”.

All these topics were explored recently at Clarity’s 4th international conference held in Lisbon, Portugal. For me, the highlights of the conference were:

- the various presentations about how design can help communication — the conference was supported by the International Institute for Information Design (IIID);

- the increased focus on testing documents on sample readers being a key part of rewriting documents.

- the government’s plain language initiatives that the conference triggered; and

- the public debate involving the legal profession that those initiatives generated.

As the President of Clarity, it was wonderful to see these developments. My deep thanks to all our sponsors and supporters — especially IIID and the Universidade Nova De Lisboa. Also, my congratulations and deepest thanks to our host Sandra Fisher-Martins and all at PortuguêsClaro.

Educaloi’s conference in Montreal, Canada

A week after the Clarity conference, I spoke at Educaloi’s conference to celebrate its 10th anniversary. Educaloi is an independent, not for profit organisation providing information and education about the legal system in Quebec, Canada.

Educaloi has long promoted the benefits of plain language — especially for consumers. One of the conference aims was to bring attention to plain language — in the minds of decision-makers and writers, especially in the legal world — as something that is as relevant to business and government as it is to retail consumers. This is something that has happened to a large extent in Australia and is increasingly happening elsewhere in the world — especially in the English speaking world. It is exciting to see it spreading.

Exciting

These are exciting times in the plain-language world.Friday, October 22, 2010

Enhancing the Cleardocs website

Lisa Galbraith, CEO

Many of you who are Cleardocs users will have noticed our updated website and navigated around the site to create new documents. The changes you see reflect many hours of discussion and feedback from our users, and what we believe will help our customers navigate our site quicker or more efficiently.

There are many experts available to assist in your web redesign and many studies to show you where people look first, and what colours people respond to. You can easily get caught up in the graphics and forget the people who visit your site to get work done. I thought it might be useful to share some of the thinking at Cleardocs on the redesign.

So what factors helped focus our redesign efforts?

Our first priority was to improve the accessibility to our resources and to tie them more closely to our products. You will now see many of our resources are listed alongside products in the product menu, and on the product pages.

Over the last 3 years the amount of information on our site has grown significantly. Our monthly ClearLaw bulletins contain legal information that is useful to our users on a daily basis. Our frequently asked legal questions have expanded. Calls to our helpline showed that not everyone understood how to find the answers to their questions.

Our next priority was to make it easier for you to get started. Some of our new callers found getting started harder than it should have been. You will have noticed the large green buttons “sign up now” and “start new documents here”.

Finally, for many of our customers the volume of documents created on Cleardocs numbers into the hundreds, and keeping track of those documents is not easy, particularly those documents that are frequently reviewed and updated – Like SMSF’s. Calls to our helpline indicated that management of the documents was at times difficult. The development of the MySMSF page and the filter tools are 2 ways of enhancing document management for our customers.

The Cleardocs website is a work place for people creating documents; any refresh of our website couldn’t slow things down. Large graphic files and music slow things down and so were rejected from any consideration.

Refreshing a website is a continual process. We will be shortly sending out a survey to see how the changes are working for our customers. Once we have that feedback we may implement further changes. So look out for the survey email and help make our website work better for you.

You can find the survey here: https://www.surveymonkey.com/s/8XNBJ8C

Monday, October 18, 2010

The Cleardocs Award for Next Generation HR – HR Leader Compass Awards 2010

Danni Kirwan, Marketing Executive

Last night Lisa (Cleardocs CEO) and I attended the 2010 HR Leader Compass Awards, of which Cleardocs was a sponsor.

As a recent entrant to the HR market, this is the first such event that Cleardocs has attended and it was great to see individuals and teams from a diverse range of industries recognised for their efforts in Human Resources.

Cleardocs was pleased to present Lauren Noonan from CB Richard Ellis with the Cleardocs Award for Next Generation HR whilst Scott Paton from Sabre Pacific was highly commended. The Next Generation Award recognises up-and-coming HR talent.

When Cleardocs launched earlier this decade we were the first company to provide online company registration with ASIC, and were seen as the next generation of “shelf company” and legal document provider. Launching our first HR document means that we again find ourselves in a new industry with many exciting opportunities for improving and advancing existing business practices.

This commitment to ongoing development and initiative is why we chose to sponsor the “Next Generation” award – because it’s a title that we are both familiar with and that we value.

The first HR document launched by Cleardocs was the HR Policies and Procedures Manual and a number of other HR documents are also in development. If you have any suggestions for HR or employment related documents, please let us know.

Friday, October 8, 2010

The Cleardocs “Form” factor

Thomas Lam, IT Manager

Apart from overall better quality of our legal documents, Cleardocs’s online ordering form is another “form factor” that distinguishes Cleardocs from its peer.

With our forms you can…

View and answer questions all in one page Multi-pages forms in general provide less satisfactory user experiences, and the reasons are quite obvious too. Users need to jump through (sometimes back and forth as well) pages to check their answers, etc. Time is wasted between closing and opening pages.

To save user’s time, we put all questions of any form into just one page. This is fine for smaller forms such as Division 7a Loan Agreement and Company Name Reservation. However, larger forms like our Company Registration form (which has over 280 questions) would be too big for users to download and work with. To make these larger forms more usable, we:

- hide irrelevant questions For example, we show 37 questions instead of over 280 questions in a blank Company Registration form;

- load relevant question blocks on demand This reduces average form download size by up to two third of its original size;

- load help text on demand This further reduces average form download size of form by another 6 percent. Replacing paragraphs of help text with help buttons also reduces cluttering of our forms.

- section bookmark buttons for quick navigation within the form Users can go to any section by clicking any section bookmark buttons. These buttons are located before and after each section in our forms.

Do less typing with auto-fill and click & paste features Duplicate data entries is not only annoying and tedious, it is also more error prone.

To save user’s time and improve data correctness, our forms have “smart” dropdowns and lists that are auto-filled when users answer relevant questions. For example, when user enters a director’s name in our Company Registration form, this name will automatically appear in a number of related dropdowns, such as the one under the “Who will chair the meeting?” question.

Recently we have also added “address picker” buttons next to address questions in our forms. These buttons allow users to click & paste an already entered address into another address question.

Fix errors quickly Apart from friendly and informative validation messages, we also added address preview boxes to our ASIC related products which helps people to identify address problems.

Recently we have reworked our ASIC validation message dialog to link errors directly to related questions on the Company Registration form.

What’s next

We’ve planned a series of form improvements after our site’s new look released on 6 Oct. So stay tune for more details.

Tuesday, October 5, 2010

My SMSF

Belinda Thalakada (Customer Service)

As Lisa’s blog touched on last week, the new site will feature a page entitled ‘My SMSFs’. This page helps organise and manage large volumes of SMSF documents created and amended by our professional users. By arranging the SMSF documents on a separate page (they are still on the My Documents page) we hope you will find it easier to find and manage your funds.

Document layout

In this section, the first thing to note is that the documents are arranged from a fund perspective. Trying to locate a client’s SMSF deed can be tedious especially if the exact date of the fund’s creation is not known. This is why, instead of listing SMSFs in chronological order (the date the document was created), they are listed by fund name in alphabetical order. So find the fund name and you find the complete document history.

How to check what law changes your deed has.

Frequently, I talk to customers about SMSF deed updates and whether one is necessary or not. Keeping track can be difficult. It’s for this reason Cleardocs allocates our SMSFs with deed ‘versions’ On the My SMSFS page, you will now be able to see a separate column which indicates the version of the Cleardocs deed your fund currently has.

Deed ‘versions’ are Cleardocs’ way of categorising what clauses your fund has in relation to the SIS Act. For example, up until July 09 2010, the latest version of a Cleardocs SMSF deed was Version 10. As superannuation law changed in regard to instalment warrants, any SMSF that was set up or updated on Cleardocs after July 9th would have a Version 11 deed and version 10 deeds would now appear as Version 10 of 11.

As on the current site, clicking on the version of the deed will open a new window detailing what your deed includes and the changes made to super law since your last update. So for the above example, a version 10 deed would refer to ‘instalment warrants’ as opposed to version 11 which refers to ‘limited recourse borrowing’. This is an extremely useful when deciding whether it is time to update the deed or not.

Ordering supplementary documents for your SMSF

Quite often our customers may need to order additional documents for their funds, such as setting up a Bare Trust or changing the trustee. Using the My SMSFs page, locate your Fund and simply click on the drop down menu next to the fund in question. Find the supplementary product you wish to order and press ‘Go’.

Tracking changes made to your deed since being with Cleardocs.

Finally, keeping track of various documents purchased for the deed through the life of the fund is often difficult for professional users who establish and manage a large number of SMSFs. The My SMSFs page makes it easier to track any changes made to their SMSFs on Cleardocs. For example, if you established a fund in 2005, updated the deed in 2007 and then did a change of trustee in 2010, all these amendments will be visible under this fund by click the green ‘More’ button found in the extreme right hand side column. Unlike the My Documents page, all the documents relate to the fund name as opposed to the product type which means if you want to know whether a certain fund has ever had an update or had a change of trustee, all you need to do is click ‘More’.

As always we are interested in finding out our customer’s feedback on any new features or products we have on our site. Either call us on 1300 307 343 or email us at support@cleardocs.com to let us know what you think!

Tuesday, September 28, 2010

The change is here (almost)

Lisa Galbraith, CEO

In mid August Danni Kirwan blogged about some upcoming changes to the Cleardocs website. I am now delighted to announce that the new Cleardocs website will be launched next week.

Over the last couple of years we have made a number of small incremental changes to our website – most of these changes have been to make it easier for you to navigate around the site and to find useful information. We feel that a complete refresh is needed and we hope that you love the changes we have made.

Firstly and most importantly we haven’t taken away any functionality from you. The “My Documents” page – where all your documents are stored is still there, the handy document filter tool is still there at the top of the “My Documents” section. You can still order additional printing and binding after you have completed your documents and we still have samples, frequently asked legal questions and ClearLaw.

So what will you notice?

The Cleardocs website is rich in useful information and we have found that this information is not as easily found as it should be. So we have added a search button at the top of the page – this enables you to search the entire site to locate the answer. This is also really helpful when searching ClearLaw articles.. We have also placed the additional information close to the product pages. For example the new product tabs will provide a list of the extra relevant information we have available such as checklists, sample docs, common legal questions and letters you can use for clients.

We have created a new SMSFmanagement page – My SMSFs. Many of our customers are now managing growing superannuation portfolios and we have noticed it can be hard to find all the changes you have made using the existing My Documents page. My SMSFs page manages your SMSF by the fund name - with one click you can see the full document history of the fund. For example you can see when you created the fund, when you last updated it and when you updated death benefit arrangements. All the document records will still be found under the “My Documents” page, but now you have a choice. For people with lots of SMSF trust deeds we hope this new page will help.

Launch process

When we launch the new website registered users will receive an announcement email the day before. When you go the website you will notice an “overlay” that will help you navigate the changes. The overlay will be available for you to refer back to – so don’t worry that it will disappear after the first viewing.

What remains the same?

Our phone number, the high quality documents and prices and of course the great Cleardocs service remains unchanged.

Look out for our announcement email and please let me know how you are finding the new website and what other changes you would like to see. I’d love to hear from you.

Wednesday, September 22, 2010

New to Cleardocs – Partnership Agreement

Danni Kirwan, Marketing Executive

Over the past few months the team at Cleardocs (with some help from Maddocks), have been working hard on our latest product launch – the Partnership Agreement. The Partnership Agreement costs $198.00 and includes the agreement and all relevant minutes.

The Partnership Agreement was developed based on customer feedback. Some of you may remember completing a short survey about the types of Partnerships you or your clients use earlier this year. Many Cleardocs products are the result of customer feedback and suggestions, so if you have any suggestions for new products we would love to hear them.

What is a Partnership Agreement?

A Partnership Agreement sets out the rules under which a partnership must act. Unless there is an agreement in place all Partners are equal, and must share profits and cover losses equally. An Agreement allows the partners to record, amongst other things:

· How profits will be shared

· How much money each Partner brings to the Partnership

· How new Partners can join the Partnership

· How partners can be removed from the Partnership; and

· The different roles and responsibilities of each partner

Why should I consider a Partnership Agreement?

As I mentioned above, unless you have a partnership agreement documenting the different roles and responsibilities of Partners, it is assumed that Partners are equal. In reality however, many Partnerships are unequal. Some Partners may be entitled to a larger share of profits because they have contributed more to the Partnership, and some Partnerships may have varying roles and levels of responsibility dependant on the expertise and involvement of the Partners.

Over time these factors or the nature of the Partnership may change, so it is wise to have a written agreement to avoid future disputes.

What’s the difference between a Partnership and a company?

First and foremost, a company is a separate legal entity that needs to be registered with ASIC. A Partnership is not a legal entity, but you will need to register the business name you wish to trade with and apply for an ABN and GST (if applicable).

A company is required to pay tax at the company rate of 30% and lodge a separate tax return, whereas Partners in a Partnership pay tax on their earnings individually and at their own tax rate.

Companies need to be registered with ASIC, and pay ongoing annual review fees. Acting as a Company Director brings with it legal responsibilities, but also offers limited liability protection (hence the term “Proprietary Limited”). In the case of a Partnership, the Partners may be held personally liable for liabilities.

Where can I find out more?

Cleardocs can establish both Partnership Agreements and Company Registrations. If you are considering starting a business, you may wish to get some advice to determine the right structure for you. To find out more about the Cleardocs Partnership Agreement click here to view the product page. If you would like to know more about registering a Pty Ltd Company, click here.

Wednesday, September 8, 2010

Clarity’s Plain Language Conference October 2010

Christopher Balmford MD

Plain-language conferences are uplifting and energising events.Clarity’s conference is on in Lisbon, Portugal in October 2010. For all sessions, there will be simultaneous translation between English and Portuguese.

Have a look at the program on the conference website here: www.clarity2010.com/home_en.html

Do come along. Also please encourage others to attend.

Plain-language advocates and practitioners often find conferences are the perfect way:

- to be reminded why they do the work they do;

- to learn from others;

- to further develop their ideas in discussions between the sessions; and

- to connect — or reconnect — with others who share their purpose.

Here’s the site: www.clarity2010.com/home_en.html

Upwards & onwards

Christopher Balmford, President of Clarity, & MD of Cleardocs

Tuesday, September 7, 2010

SMSF Borrowing to acquire multiple assets — reduced prices from Cleardocs

Christopher Balmford, MD

If an SMSF needs multiple SMSF borrowing document packages, Cleardocs has reduced prices for the second and later orders. The discount is useful for SMSF trustee(s) who are acquiring more than one asset through more than one SMSF borrowing — whether at the same time or over a period, . . . even a lengthy period.We can also help those SMSF trustee(s) and their advisers by automating an “order-replication process” for multiple orders. How many? . . . Well:

- several of our customers have needed a dozen or so SMSF borrowing document packages for the one SMSF; and

- one of our customers needed more than 100 document packages for the one SMSF. And he needed them all on the same day . . . our automated “order-replication process” saved him and his staff a lot of repetitive typing.

Why is the multiple order price reduction required?

The price reduction is in response:- to the 7 July 2010 law change about SMSF borrowing — which clarified that each SMSF borrowing can be used by the SMSF’s trustee(s) to acquire only one asset, see below; and

- to customers who — to comply with the law — need a separate document package for each borrowing.

Although the law changes that came in on 7 July 2010 confirm that for each borrowing the SMSF’s Trustee(s) make they can acquire only a “single acquirable asset”, there is a useful clarification for shares etc. The clarification is that the concept of “single acquirable asset” covers:

- a holding of shares in a company, a holding of units in a trust, or a holding of stapled securities (that is, shares in a company that are stapled to units in a trust);

- as long as that holding is of shares, or units, or stapled securities of the same class with the same market value.

For example, if the SMSF’s trustee(s) borrow to buy 10,000 ordinary shares in company X at $1.00, then that holding is seen as one asset. If the SMSF trustee(s) want to borrow to acquire another 2,000 of those shares at $1.04, then that second holding is a separate asset — and it requires a separate borrowing and a separate set of SMSF borrowing documents.

Similarly if the SMSF trustee(s) were to acquire 2 properties at the same time — each on a separate title — then the trustee(s) would need a separate borrowing and a separate set of SMSF borrowing documents for each property.

What sort of SMSF needs a dozen or so SMSF borrowing packages?

One of our customers is arranging for his own SMSF to borrow a fair amount from one of his related entities. Over the next few months or so, his SMSF’s trustee wants to use the loan money to acquire shares in about 12 different companies.

The new law makes clear that each time the trustee of his SMSF acquires shares — of the one company, in the same class, and at the same price — the trustee is acquiring a separate asset. Therefore:

- each time the Cleardocs customer acquires a separate holding, he needs a separate borrowing; and

- each of those holdings must have a separate set of documents — including: a separate loan agreement, a separate security document, and a separate declaration of custody trust (under which the custodian holds the asset on trust for the SMSF).

One of our accountant customers was acting for a client who was buying more than 100 car spaces (before the recent law change). As each car space had its own Certificate of Title his bank took the view that each of them was a separate asset. Therefore, each car space needed to be covered by a separate borrowing and so required a separate set of documents. (By the way, our customer’s client was borrowing the money from one of the big 4 banks — apparently, the bank manager was somewhat irritated at having to prepare so many sets of loan documents.)

How does Cleardocs automate the “order-replication process”?

For the customer ordering the document packages for the 100+ car spaces, each order was going to be identical — other than for the Folio number on the Certificate of Title. So our IT Manager, Thomas Lam, wrote a bit of code that:

- created each new order;

- gave each new order an identifying name (which included the Folio number); and

- pre-populated each set of answers for each of the other 100+ orders — even to the extent of automatically changing the Folio number for each order.

To make sure the automation was working properly, we did the first 3 orders one-at-a-time for our customer to check. He checked and confirmed they were correct. Then in one click we did the other 100+ orders for him.

It’s fair to say our customer was delighted by the efficiency delivered by the Cleardocs IT, and by Thomas. And he appreciated the significant discount we gave him too.

What are the reduced Cleardocs prices for multiple orders?

Cleardocs has reduced prices for the second, third and so on (even the 100th) of the same type of borrowing package for the same SMSF to a flat $99 a package.

Here’s how the discount works for the 2 customers mentioned above:

- the Cleardocs customer buying shares in a dozen companies through a borrowing from a “related party”, pays the full fee ($598) for the first related party document package. But pays only a flat $99 for each related party borrowing package they buy later for the same SMSF; and

- the Cleardocs customer buying 100+ car spaces through a borrowing from a “bank”, paid the full fee ($199) for the first related party document package. But paid only a flat $99 for each of the other bank borrowing packages they bought.

(By the way, the main difference between the Cleardocs documents package for a “bank” lender and a “related party” lender is that the “related party” package includes a loan agreement and, if the asset being acquired is a holding of shares etc, it also includes a security document.)

Did the law changes on 7 July clarify anything else?

Yes, the 7 July law change also clarified that:

- The borrowed money can be used to meet expenses incurred in connection with the borrowing;

- If the original asset purchased is shares, units, or stapled securities, then the original asset can be replaced — but only with shares, or units, or stapled securities, in the same entity and in the same class and of the same market value; and

- The SMSF can refinance its borrowing.

You can read other articles concerning superannuation and SMSFs here.

Order SMSF related document packages

Set up an SMSF

Update an SMSF deed

Set up an SMSF pension

Arrange SMSF borrowing lending docs:

Set up an SMSF corporate trustee

SMSF Death Benefit Nomination - binding or non binding

SMSF Death Benefit Agreement - binding or permanent

Thursday, September 2, 2010

From the Helpdesk: Life on the line

Belinda Thalakada, Customer Service

Being new to the Cleardocs helpdesk was somewhat overwhelming — especially getting my head around all the different products, processes and generally how Cleardocs works. I guess it’s similar to how a first-time user might feel.

Thankfully, after touring the site, I found the Resources section to contain pearls of wisdom and gems of information about most customer queries for almost all our products. Those pearls and gems might not be all too obvious for the average Cleardocs user, so I thought in this post I’d explore the Resources section with you. I find extremely helpful for me and for customers time and time again.

From this section of the site you can access:

This resource allows you to download ‘dummy’ versions of particular products in a PDF reader so you can look at how a Cleardocs deed, constitution or any other document is set out and what it includes/excludes

This resource is particularly useful for customers who know what sort of product they want to purchase but who are unsure on how to get the proverbial ‘ball’ rolling to set up a company, trust or SMSF. The Checklists tell you the information you need to have with you help you answer the questions on our interface when ordering a document package.

When there are changes in the law that are likely to affect any of the Cleardocs products, the type change and its potential impact are reported in this regular monthly bulletin. As well as these updates, the bulletin includes articles that help deepen your understanding of existing products — for example: Understanding the Cleardocs trusts: Part 1 of 2 & Part 2 of 2.

- Blog

The blog provides useful information and helpful hints about our products or issues relating to our products and gives us an opportunity to provide further commentary on specific topics. The blogs themselves range from the more technical (for example, why we don’t provide Change of Trustee for a Discretionary Trust Blog Jan 2010) to commentary about the practical application of our products and general observations that may be helpful to our customers

- Links

As the title suggests, this resource lists links to external sites that may be useful in providing more information about ASIC, ATO, State Revenue Offices, Superannuation services etc. In this section, you are able to find links to useful sites such as the ASIC Identical Names Check, GST and ABN registration, stamp duty set by state revenue offices and so forth.

There’s a lot on the site

There’s lots of information on the Cleardocs site. It’s worth having a good wander around. But if you can’t find something, or you’re too busy for a wander, call us on 1300 307 343.

Monday, August 23, 2010

How does a trust own shares or units? . . . Who can own shares or units? Or maybe what can own shares or units? (Because “a trust” can’t own them . . . )

Christopher Balmford, MD

The only “things” that can own shares in a company — or units in a Unit Trust or a Hybrid Trust — are humans or companies. The humans or companies can own the shares or units by themselves or as part of a group. (When thinking about the word “company”, remember that it refers to any type of corporate entity — for example: a “Pty Ltd” company, a “Limited” company, and a corporate entity created by statute.)

So because only humans or companies can own shares or units, it means that:

- a dog, can’t own shares — nor can an elephant, a brick, a hockey stick, or a glass of wine; and

- if shares are going to be “owned on trust”, then they are to be owned by the trustee(s). The point is that the shares aren’t owned by the trust, they’re held (that is owned) on trust by the trustee(s).

This is true for any sort of trust, for example: a Discretionary (Family) Trust, a Hybrid Trust, a Unit Trust, a Bare Trust, a Declaration of Custody Trust (for SMSF Borrowing) and even for an SMSF.

Confusion around this issue troubles many people when they are ordering documents online from Cleardocs.

For example: Someone might be ordering a new company registration from us and they know that some of the shares are going to be held on trust. But on the Cleardocs interface, they can see that we offer them the choice of shares being owned:

- by one of the directors — who has to be a human;

- by a human who is not a director;

- by an organisation;

- by a joint holding — of humans or companies or both.

The customer is puzzled because they think the shares should be owned by the trust . . .

Solution The solution to this apparent puzzle is for the customer to remember that the shares are held by the trustee(s) — and the trustee(s) are always one or more humans or companies. The position is exactly the same if units in a Unit Trust or a Hybrid Trust are themselves held on trust for another trust.

When someone using Cleardocs remembers that the shares (or units) are held by the trustee(s), then they can make the appropriate choice from the list of types of shareholder the Cleardocs interface offers. When they’ve done that, the interface then asks if the shares are to be held by the trustee(s) on trust.

It’s easy really, as long as you remember the shares — or units — aren’t held by the trust, they’re held on trust by the trustee(s).